Loading

EP 745 | AIRED 06/16/2025

Summer Slowdown: Dungeness, Snow Crab & Halibut Supply Tightens as Salmon Season Begins

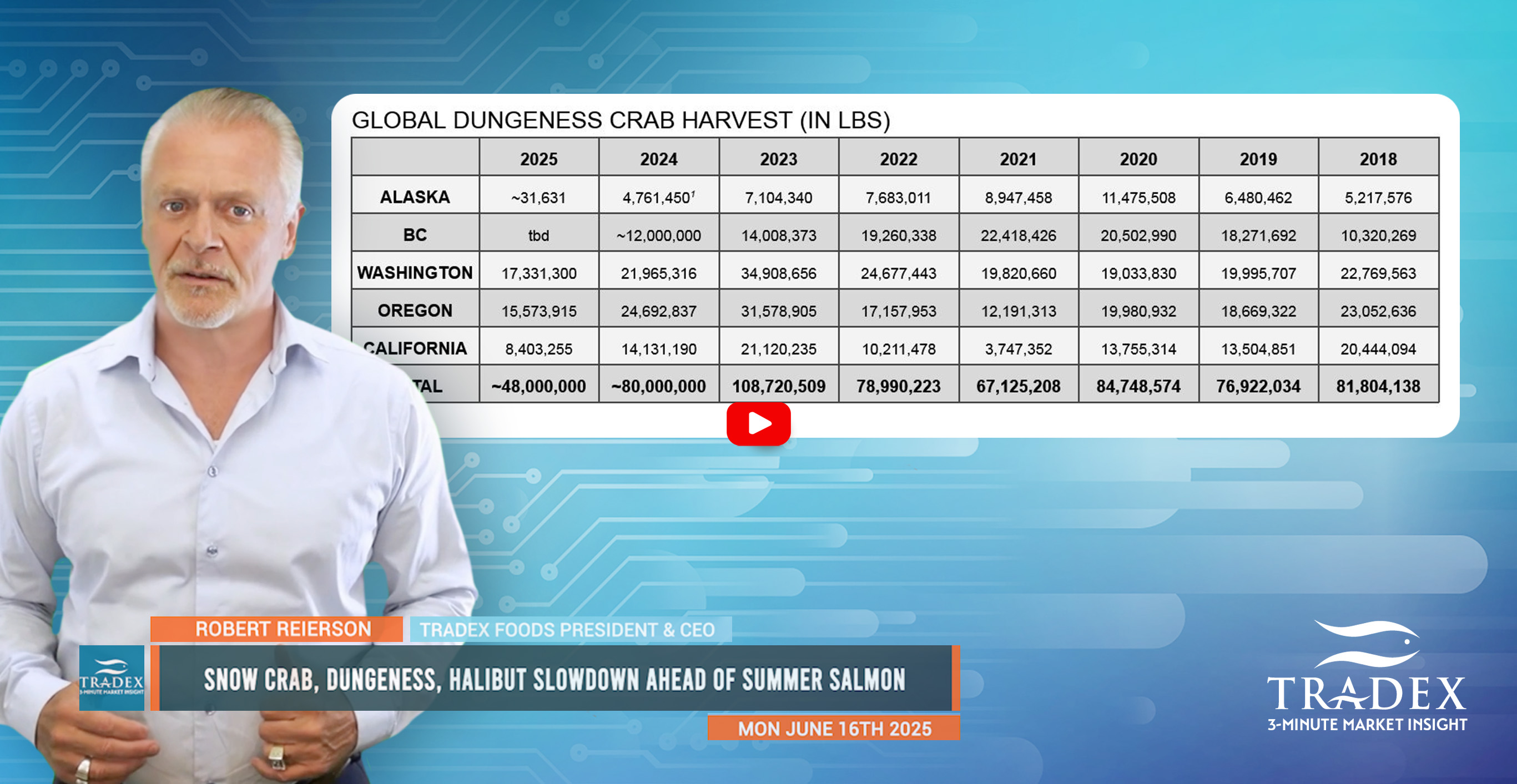

June 16th, 2025 - To start, Dungeness crab fisheries in Washington, Oregon, and California (WOC) have already harvested the majority of their annual catch, with landings now expected to taper off as the season winds down. So far, approximately 41 million pounds have been landed from these states - about 65% of last year’s total. If history repeats itself, delayed fishery reopenings could mean no new-season product until early 2026.

To start, Dungeness crab fisheries in Washington, Oregon, and California (WOC) have already harvested the majority of their annual catch, with landings now expected to taper off as the season winds down. So far, approximately 41 million pounds have been landed from these states - about 65% of last year’s total. If history repeats itself, delayed fishery reopenings could mean no new-season product until early 2026.

In British Columbia, Canada, the Dungeness fishery operates year-round, with peak activity typically in summer. However, following four years of high output, 2025 may see another year of lighter catches. Still, Canadian Dungeness remains a reliable, tariff-free option for U.S. buyers under the USMCA.

Alaska’s Dungeness season has just begun, but it remains the smallest of the producing regions by volume. Preliminary figures point to around 5 million pounds landed last season, continuing a downward trend.

For Snow Crab, in Newfoundland and Labrador, about 60% of Canada’s snow crab total allowable catch has been landed, leaving roughly 27,000 tonnes expected by the July 31 season close. This would bring Canada's 2025 total to around 90,000 tonnes - maintaining its position as the world’s largest snow crab producer.

Alaska’s season has concluded with 4.7 million pounds harvested. Norway has also nearly completed its 12,000 tonne quota, while Russia is still fishing and likely to fulfill its 48,000 tonne TAC. However, Russian product remains largely inaccessible to North American buyers due to ongoing sanctions.

Advertise Here: advertising@tradexfoods.com

According to Les Hodges, Canadian snow crab imports into the U.S. are on track to meet or exceed 2024’s 112.9 million pounds. Retail continues to account for 60–65% of U.S. sales, but with prices up 30–50% year-over-year, retail demand may weaken.

Buyers should anticipate steady Canadian supply through summer 2025, but should also prepare for higher prices and fewer retail promotions. Canadian crab remains the most viable option—both competitively priced and tariff-free—while Norway’s high-quality product is less price competitive.

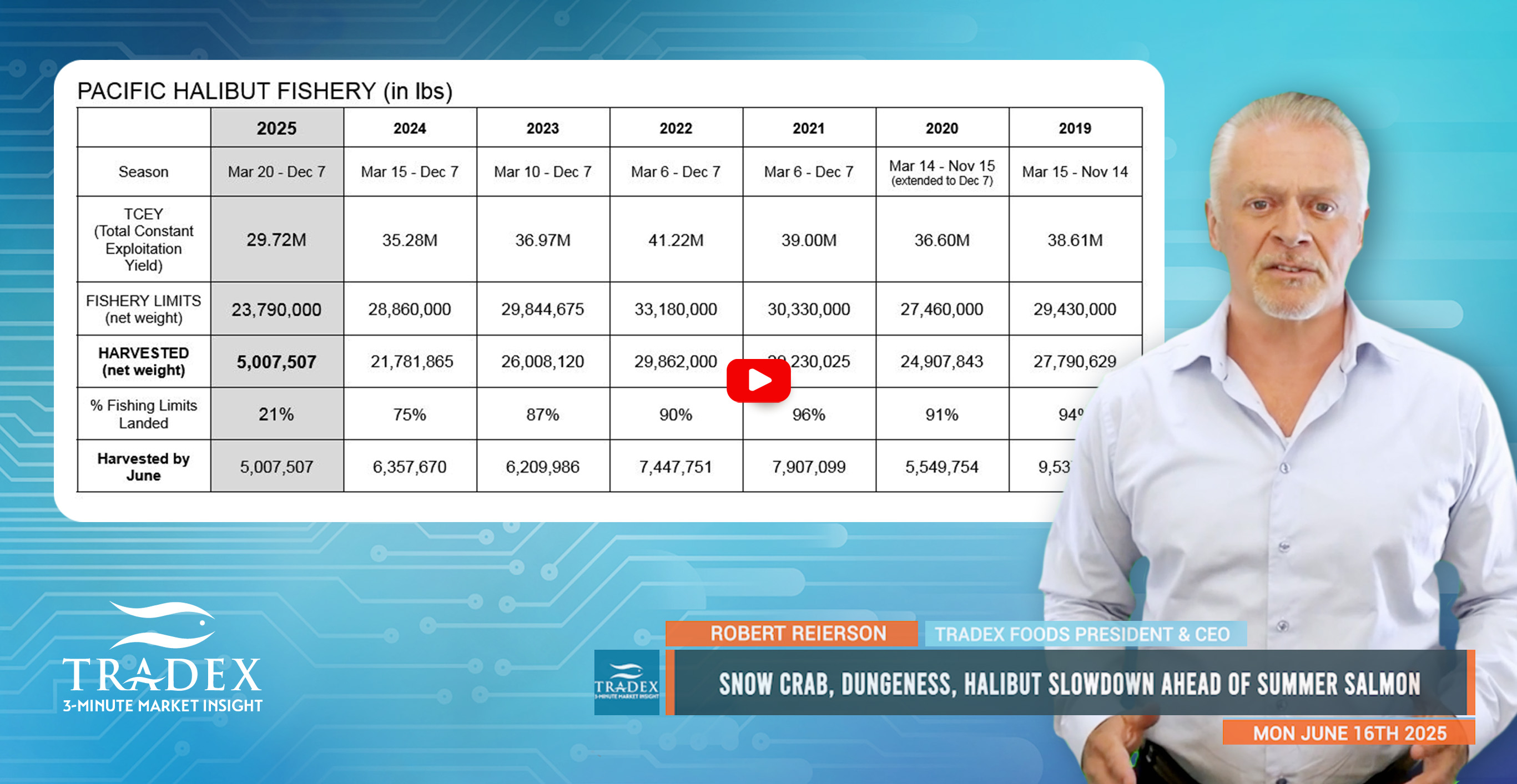

Moving on to Halibut, Pacific halibut harvests are not only slowing seasonally, but are also lagging significantly behind last year—by nearly 1.5 million pounds to date. This follows a record-low TCEY for 2025, with the quota reduced by 5 million pounds from the prior year. As a result, halibut availability is expected to fall short of projections, leading to potential shortages in both fresh and frozen markets as the season progresses.

Our recommendation is to secure your Dungeness Crab and Halibut requirements as there will be a tightening of supply, and for Snow Crab to monitor pricing and supply as the largest Canadian snow crab fishery will come to an end by the end of July.

Ending this report with a Salmon primer and the industry should see landings of Alaska Sockeye, Chum, and Chinook start to pick up in the coming weeks, followed by a robust Pink salmon year in August. Be sure to subscribe to our Market Insights as we will start our reporting on Summer Salmon species week to week.

--- If you’re not already, be sure to subscribe to our 3-Minute Market Insight for seafood updates and insights delivered right to your inbox.