Loading

EP 738 | AIRED 04/28/2025

2025 Snow Crab Market: Global Supply Outlook, Price Outlook, Tariffs Business as Usual

April 28th, 2025 - Despite all the recent tariff turmoil and price negotiations that always precede the start of the world's largest Snow Crab fishery, it seems the snow crab market is business as usual - for the most part.

At the time of reporting, Canadian snow crab can continue to move into the United States without any additional tariffs and will continue to do so unless tariff tensions escalate again between Canada and the U.S.

For Newfoundland & Labrador (Canada’s largest snow crab producing fishery) had the Standing Fish Price Setting Panel announce the 2025 minimum price for snow crab of $4.97/lb, which is higher than the $2.20 set the last 2 years, but down from a high of $7.60 set in 2022.

For the Southern Gulf of St. Lawrence (Canada’s second largest snow crab producing fishery), UCN recently reported shore prices of up to $5.25/lb but also that those prices are not viable for most processors.

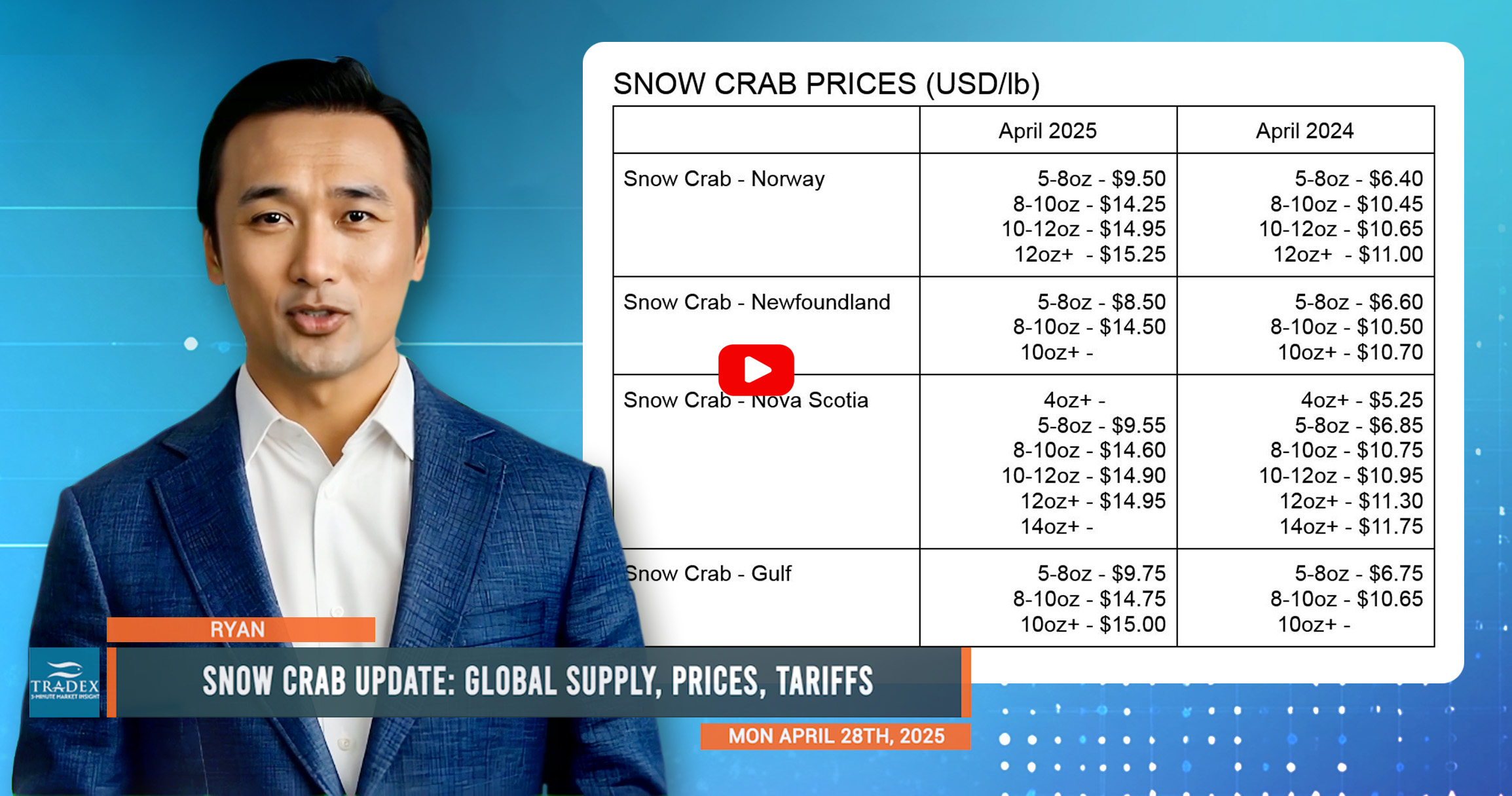

Current market pricing for snow crab is averaging about 37% higher than this time last year - equating to roughly $2 to $4 higher.

Canada’s three main snow crab fisheries have landed over 20% of their combined TAC - just over 86,000 tons, slightly below last year’s 90,000. The Gulf fishery is over 60% landed, following a 13% preseason quota revision.

The Alaska Snow Crab fishery, which began in January, has now wrapped up with 100% of its 4.72 million-pound (or 2,100 ton) TAC landed.

Advertise Here: advertising@tradexfoods.com

Norway’s snow crab TAC rose 30% this year, having landed about 11,000 tons, or 80% of the limit already. While Norway has already exported a considerable amount of crab to the U.S., tariffs will reduce competitiveness vs Canadian products now.

Russia, the world’s second-largest snow crab producer, has a Far East and Barents Sea combined TAC of 48,000 tons - up 4% from last year and consistent with prior years. With the exception of last year, it has averaged about 97% harvest completion in recent years.

More Russian crab may flow into China as a result of China and Canada’s tariff tensions. However, as reported by Les Hodges, diplomatic talks in Riyadh could lead to lifted sanctions on Russian seafood, returning Russian king/snow crab to the U.S..

Globally, we may see upwards of 150,000 tons of snow crab harvested, resulting in up to 10,000 metric tons (or 22 million pounds) more snow crab than last year.

Our recommendation continues to be that you secure your seafood requirements now. While prices often dip after the season opens before trending upward, this year is anything but typical—any supply chain disruption could quickly alter pricing.

--- If you’re not already, be sure to subscribe to our 3-Minute Market Insight for seafood updates and insights delivered right to your inbox.