Loading

EP 712 | AIRED 10/14/2024

Haddock Update: Remaining Harvest, Raw Materials Pricing, Wild Whitefish Alternative

October 14th, 2024 - Haddock may be your next best alternative value whitefish as the market continues to be short on Cod and Pollock amidst rising prices due to low supply.

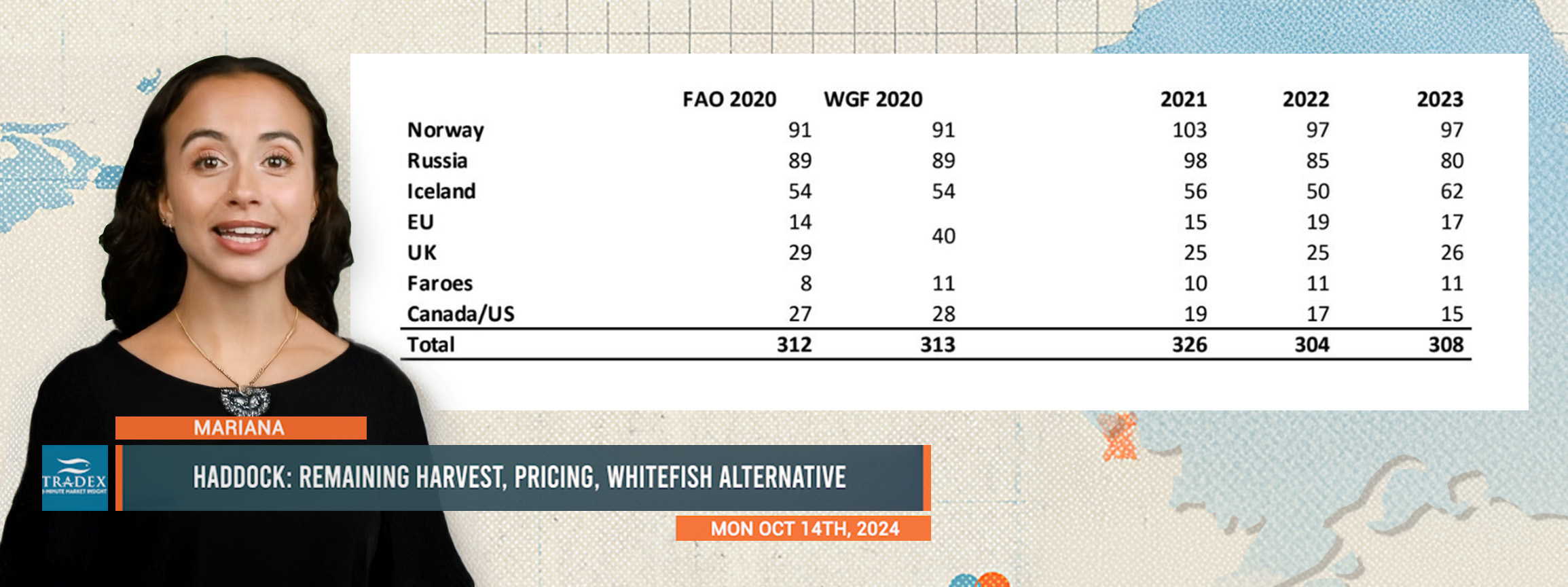

Norway, Russia, and Iceland are the world's top producing countries for Haddock supplying over 75 percent of 300,000 metric tonnes annually harvested globally.

Sources close to Tradex have advised that Haddock fishermen in Norway may be halting their direct fishing efforts - instead opting to harvest the remaining quota as bycatch.

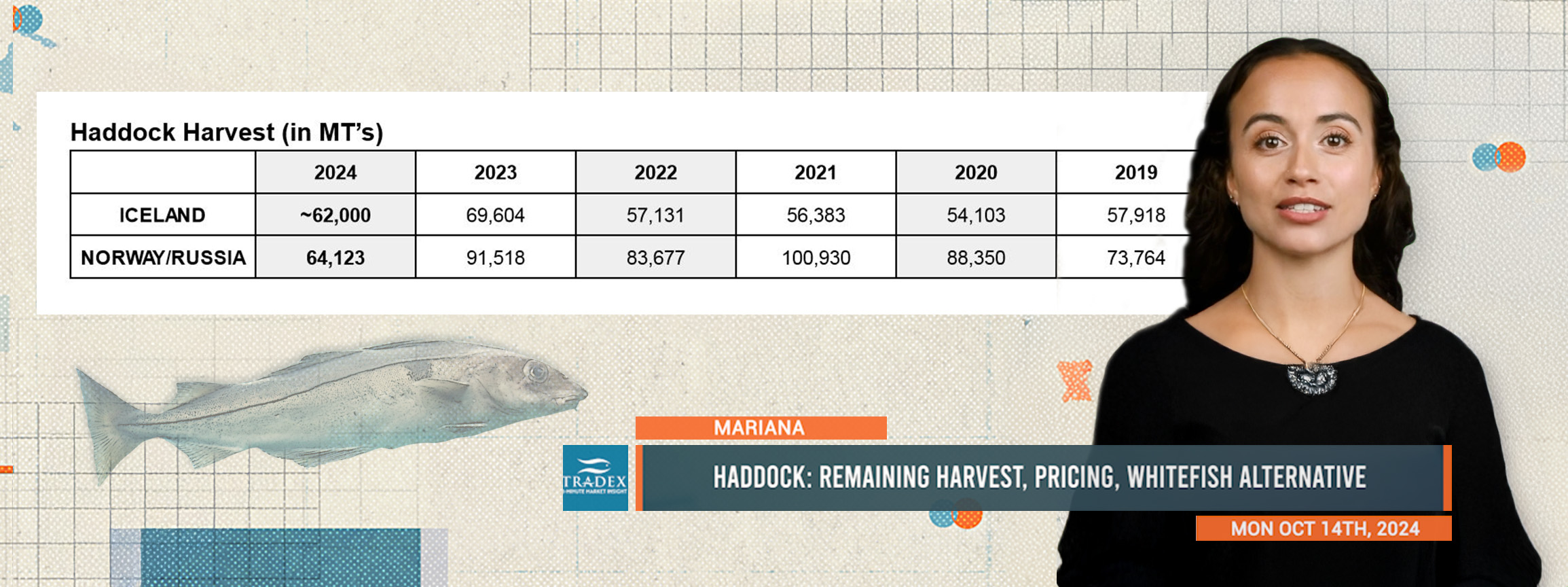

Norway and Russia share a jointly managed haddock fishery, which has so far yielded approximately 64,000 metric tonnes this year — about 10 percent (or 7,300 metric tonnes) behind last year's pace. In 2022, the combined harvest from these two countries totaled about 91,000 metric tonnes, surpassing the 5-year average.

Meanwhile, Iceland's current haddock harvest stands at around 62,000 metric tonnes, which is 27 percent (or 13,000 metric tonnes) ahead of the same period last year. If the fishing pace continues similarly to last year, up to an additional 20,000 metric tonnes could be harvested by the year’s end.

Advertise Here: advertising@tradexfoods.com

Raw materials pricing out of China has hovered around $3900 per metric tonne all summer for Russian fish, while Norwegian fish kept at around $4300. Although these prices are almost $1000 more than last year, 2023 may have been an outlier driven by unique supply-demand dynamics and global economic factors, as Haddock pricing throughout 2024 are similar to 2022 and 2021. It is interesting to note that 2023 saw one of the highest global salmon harvest on record at 1.1 million metric tonnes globally while 2024 could be one of the lowest on record.

With Pacific and Atlantic cod and pollock in short supply, haddock presents itself as a strong alternative.

Our recommendation is to act swiftly on available haddock offers, as prices may face additional upward pressure. Importantly, Russian-origin haddock remains available for import into the U.S., as it is not subject to any bans.

--- If you’re not already, be sure to subscribe to our 3-Minute Market Insight for seafood updates and insights delivered right to your inbox.