Loading

EP 736 | AIRED 04/14/2025

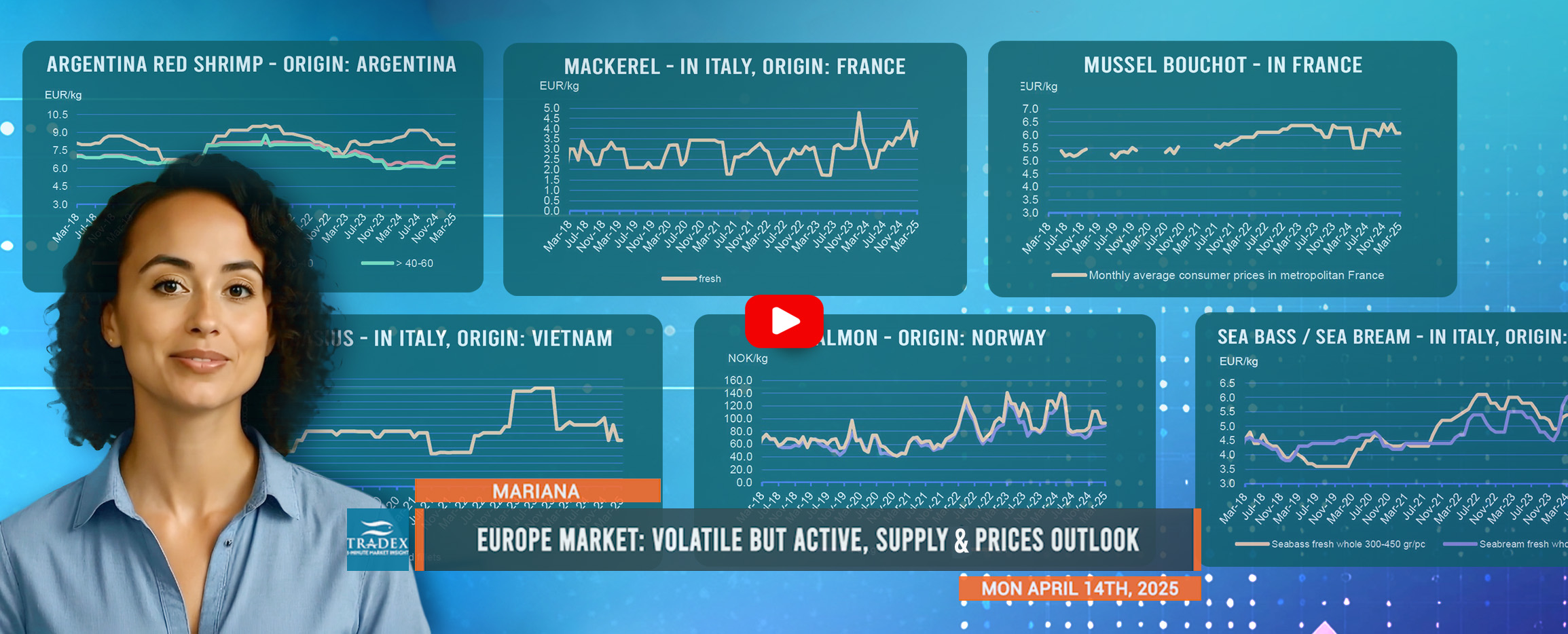

Europe Market Update: Market Resilience Tested by Tariffs, Tighter Supply Across Key Species

April 14th, 2024 - The global seafood market in early 2025 continues to face pressure from trade tensions and unstable harvests, with tariff disputes reshaping supply chains and buyer relationships. Despite these macroeconomic challenges, European buyers remain active across key species, with pricing reflecting a mix of supply constraints and shifting regional demand.

For groundfish and flatfish, Norwegian cod landings are up, slightly easing prices despite reduced quotas. Salted and unsalted cod remain uncertain due to high input costs and declining traditional consumption in southern Europe. Sole prices stay elevated, particularly for smaller sizes, driven by steady demand.

For farmed salmon and trout, Norwegian salmon volumes are rising due to favorable farming conditions, with strong exports to Poland, the US, and France. Scotland posted record export values in 2024, fueled by growth in France, the US, and China. Trout exports also gained momentum, especially to Ukraine and Southeast Asia.

Just a quick note on the upcoming wild salmon season. Both Alaska and Russia’s summer salmon season will get going around June. This odd-number-year will see a higher harvest than last year led by pink salmon. Sockeye forecasts out of Alaska are projected to be another strong year. Russia’s pre-season forecast is for 311,000 metric tons which is 32% higher than last year’s harvest, but 49% lower than the last odd-year’s record harvest in 2023. Alaska should be releasing their 2025 salmon forecast in the coming weeks.

Small pelagics in Norway saw strong herring exports in February, supported by demand from Germany and Denmark. Global mackerel volumes are tight, but EU markets are absorbing available supply well, with strong demand from Asia.

Advertise Here: advertising@tradexfoods.com

For tuna, skipjack remains in short supply, keeping prices high, while improved yellowfin availability has eased prices in Europe. Tuna loins, especially cooked and cleaned, have adjusted downward due to improved inventory control.

For cephalopods & crustaceans, EU prices for squid and octopus remain volatile amid weak catches in South Africa and disrupted harvests in Indonesia, though Argentina’s season is strong. Crustacean demand is subdued but may rebound around Easter. King crab prices have surged due to limited global supply and strong US demand, while invasive blue crab continues to affect Mediterranean shellfish farms.

France’s oyster market is thriving on demand for sustainable, premium seafood, despite ongoing water quality concerns. Sardinian clam and mussel producers face pressure from invasive species. Turkey remains the EU’s top supplier of seabass and seabream, offering stable prices and competitive exports amid currency advantages.

Looking ahead, European seafood buyers should prepare for continued volatility to persist as trade policies and harvest conditions evolve. While categories like salmon and pelagics show strength, others—such as cephalopods and crustaceans—face supply risks and pricing instability.

Amid on-going tariff negotiations, our recommendation is to continue securing supply for your market’s needs. So long as demand for food persists, the supply chain will need to keep moving. Buyers should diversify sourcing across regions and species, prioritize value-added formats (to meet evolving consumer demands), and monitor evolving consumer trends, regulations, and environmental impacts to mitigate risk and capture opportunity.

--- If you’re not already, be sure to subscribe to our 3-Minute Market Insight for seafood updates and insights delivered right to your inbox.