Loading

EP 726 | AIRED 02/03/2025

EU Market Update: Rising Costs, Supply Challenges, and Trade Uncertainty to Shape the EU Seafood Market in 2025

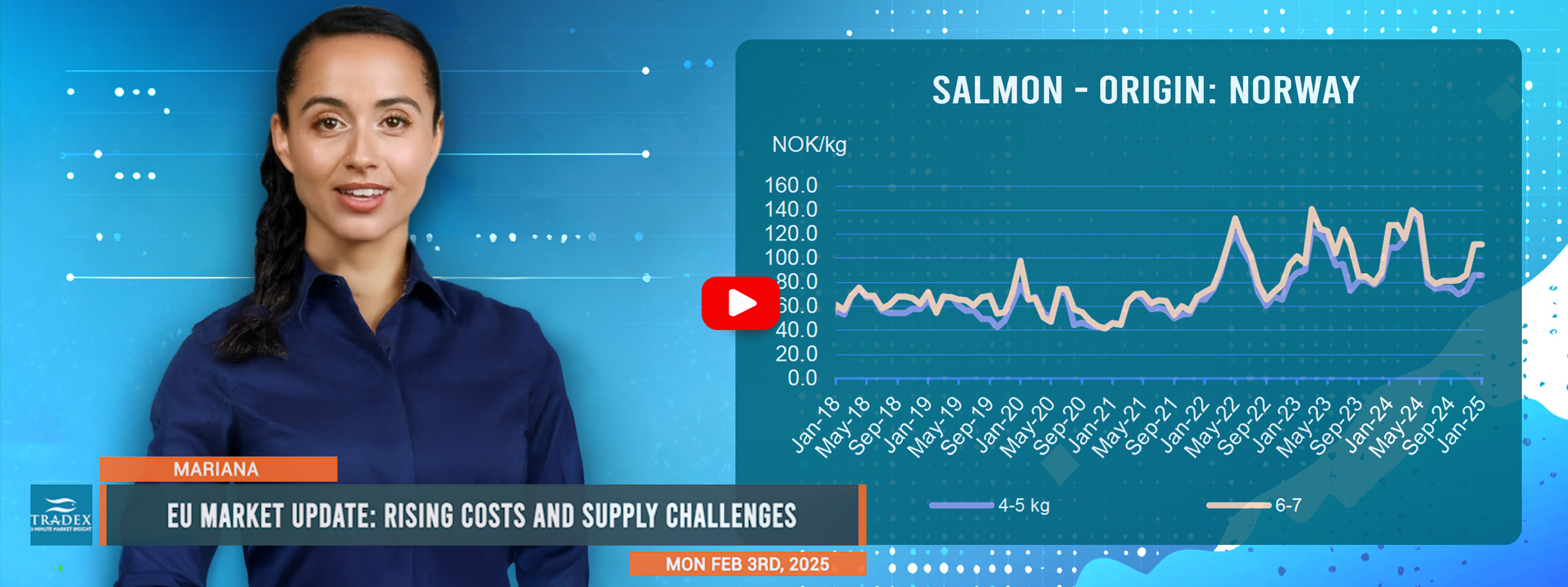

February 3rd, 2024 - The beginning of the year is traditionally a slower period for seafood consumption in Europe as post-holiday demand declines. However, this year, seafood prices have surged due to rising fuel costs and reduced fishing quotas. While 23% of products saw price increases, 20% recorded declines, with inflation in the Euro Area reaching 2.4% in December 2024, adding further pressure on the market.

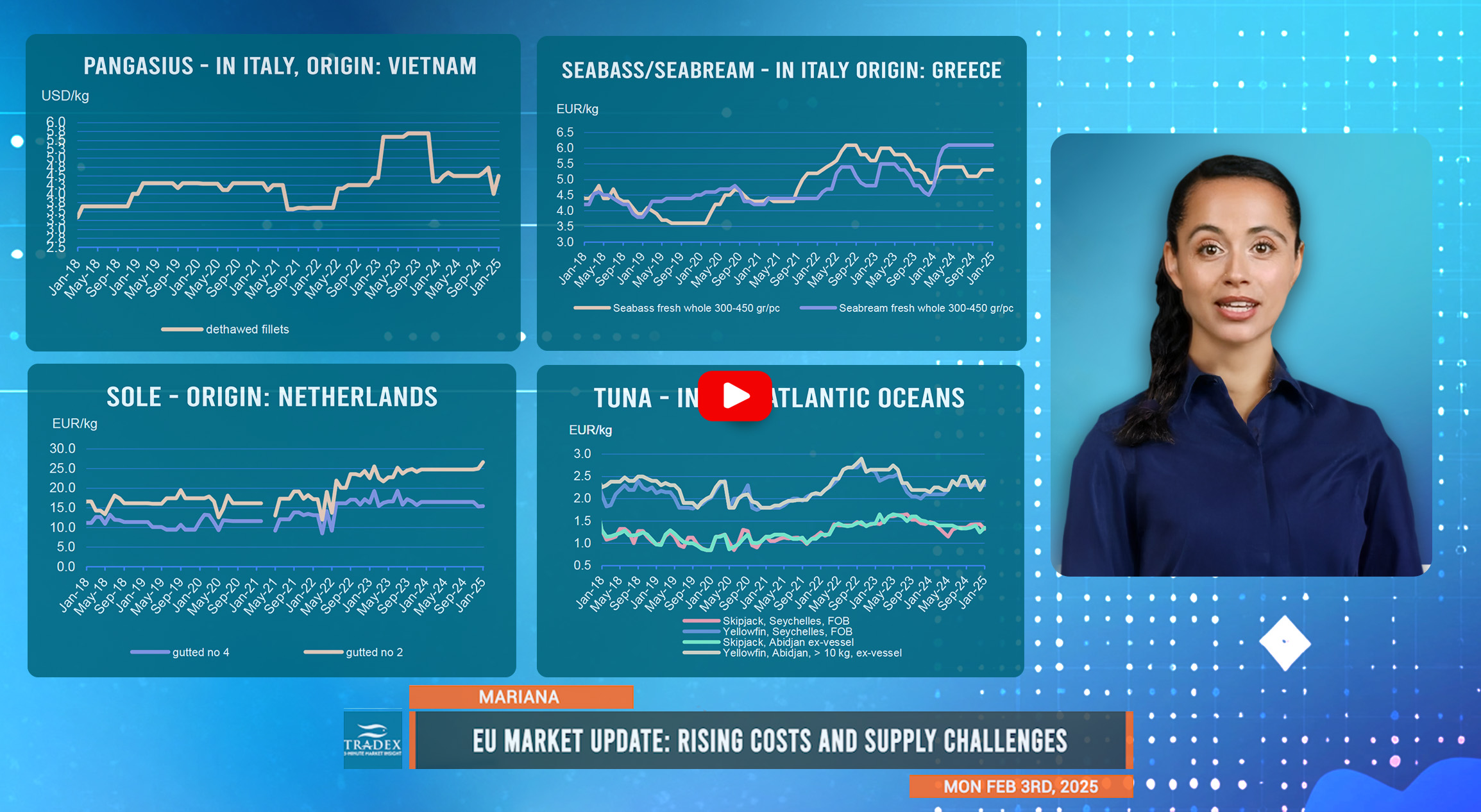

Higher costs for capture species, particularly groundfish and crustaceans, have driven up prices. Inflationary pressures continue to impact supply chains, while reduced quotas and poor catches—such as South African squid and Atlantic cod—have constrained availability.

Seafood shortages and rising prices persist, with groundfish and flatfish in high demand. Tuna prices are set to rise due to Pacific and Indian Ocean supply constraints, while sardine prices surged as Moroccan catches went to fishmeal. Cephalopods saw poor squid landings but a 23.6% boost in Morocco’s octopus quota. Crustaceans rose on holiday demand, with shrimp up $0.10–$0.15/lb (or €0.20–€0.30/kg) and Italy’s clam supply collapsing. Norwegian salmon exports grew 1%, while trout surged 32% in volume.

France and Spain show strong demand for crustaceans and cephalopods, with France also a key mussel importer, while Germany leads in pangasius consumption as a budget-friendly choice. Italy remains a top market for seabass and seabream, with Greek and Turkish imports as low as $3.30/lb (or €6.99/kg), while local fish commands higher prices.

Overall the EU seafood market faces rising costs and supply constraints, driven by climate change, inflation, and declining fishery yields in key regions like the South Atlantic, Indian Ocean, and North Africa. While quota adjustments, aquaculture expansion, and import diversification offer resilience, buyers must prepare for long-term price pressures.

Additionally, Trump's proposed tariffs could drastically hinder EU seafood exports to the U.S., forcing companies to diversify markets or shift operations. Potential EU retaliation may further destabilize trade, leading to price volatility and shifting global demand.

Advertise Here: advertising@tradexfoods.com

Our recommendation is to partner with stable and long-term suppliers that can help secure pricing against market volatility.

Despite ongoing supply constraints, inflationary pressures, and potential trade disruptions, the EU seafood market remains resilient, with shifting production strategies and market diversification key to navigating rising costs and evolving global demand.

--- If you’re not already, be sure to subscribe to our 3-Minute Market Insight for seafood updates and insights delivered right to your inbox.