Loading

EP 725 | AIRED 01/27/2025

Snow Crab Forecast: Low Inventory, Upward Price Pressures, Tariffs, Russia Supply Wild Card

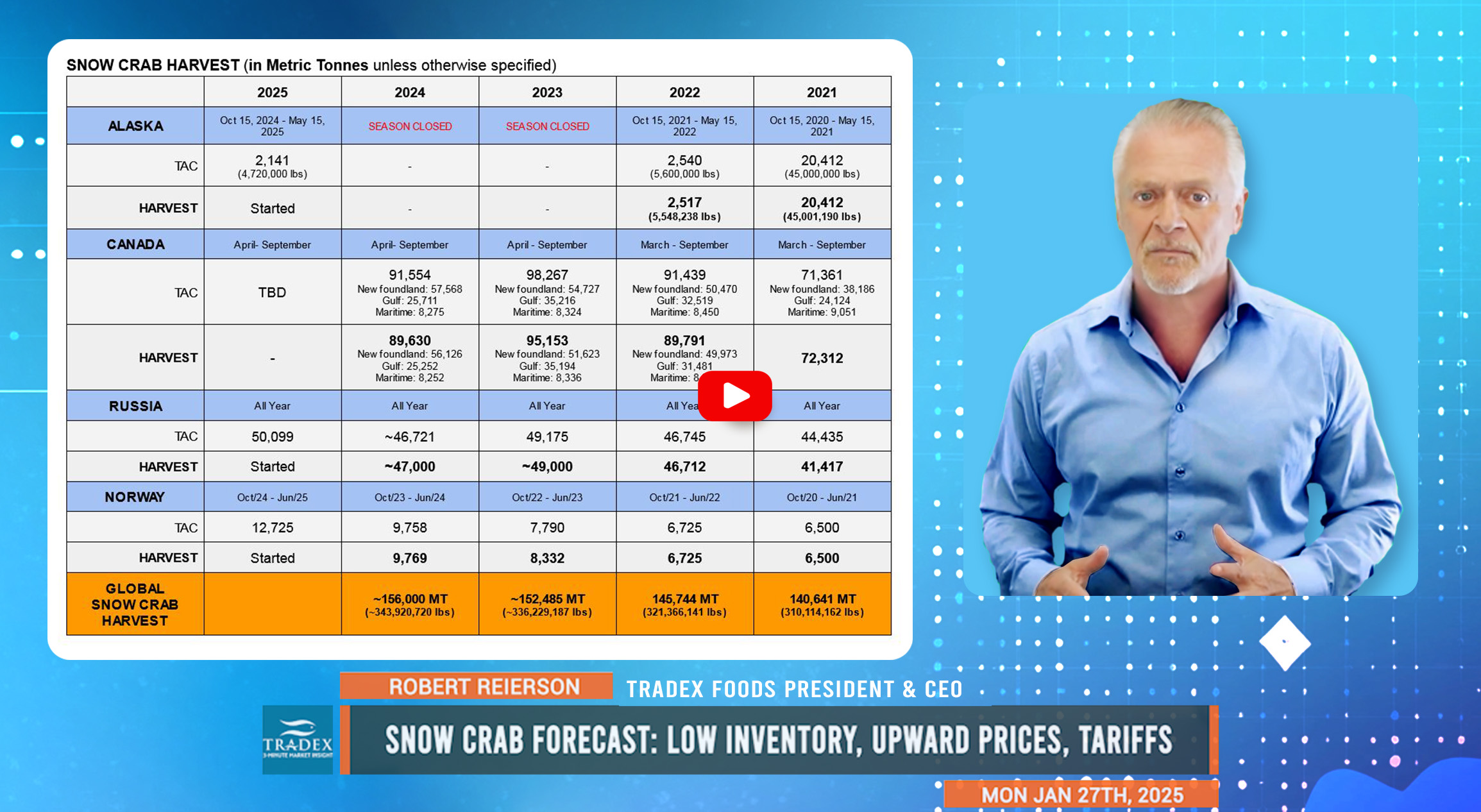

January 27th, 2025 - The start of Canada’s snow crab fishery in April typically sets the tone for the market as it is the largest Snow Crab fishery in the world harvesting over 100,000 metric tons annually.

The industry now sits on edge as snow crab harvesters, processors, and buyers in Canada and the U.S. await decisions and then consequences on new trade tariffs between the USA and Canada.

The US imports upwards of 50,000 metric tons (or 110 million pounds) of Canadian snow crab annually, and according to a recent report by Les Hodges, “Canadian snow crab accounts for 91% of all U.S. snow crab imports followed by Norway with 7.9 million pounds for a 6% market share.”.

This year marks the return of Alaska's snow crab fishery after a 2 year closure, with harvests just beginning to trickle in. However, the total allowable catch remains significantly lower than in previous years, capped at around 4.7 million pounds (or 2100 metric tons). While this resource is tariff-free for the lower 48, scarcity and price pressures will be a real issue.

Russia’s snow crab Total Allowable Catch increased to almost 51,000 metric tons this year however, at the time of reporting, Russian crab, and Russian origin crab is still banned from entering the US.

Norway increased its snow crab Total Allowable Catch to over 12,000 metric tons, up about 3,000 from last year. The season started on January 1, with only small volumes said to be exported - and Norway typically harvests 100% of its limit.

Advertise Here: advertising@tradexfoods.com

After several years of abundant carryover inventory, Canadian snow crab prices have surged by 49% year-over-year. Current FOB Boston pricing exceeds $9 per pound for 5-8 oz sections and $13 per pound for 8-up oz. The key difference now is the extreme scarcity of North American snow crab supply.

Regardless of the outcome of the tariffs, further price increases are inevitable due to limited inventory. However, there is a ceiling to what consumers are willing to pay. Once that threshold is reached, prices will likely decline or hold. With the U.S. market imposing tariffs, more Canadian supply could shift to China, where it would compete directly with Russian snow crab, which is currently banned in the U.S.

Pricing and supply will also depend on the price Canadian fishermen negotiate before the season begins. Last year’s minimum was $3, up from $2.20 in 2023, but still below the $6.15 and $7.60 seen during high-demand years. If forecasts of higher snow crab prices hold true, harvesters could see better payouts this year.

Our recommendation is to secure your snow crab supply all while keeping tuned into US trade policy changes - and you can do both of these things through Tradex Foods and the 3-Minute Market Insight.

--- If you’re not already, be sure to subscribe to our 3-Minute Market Insight for seafood updates and insights delivered right to your inbox.