Loading

EP 537 | AIRED 05/10/2021

China: Raw Materials Moving, Pricing Stable but Predicted to Rise Dramatically

May 10th, 2021--- This week we provide China Update for the Twice Frozen Market as our sources in China are calling for a moment of calm, before the storm.

--- The supply chain is still strained on twice frozen seafood products as Chinese port authorities continue to implement strict Coronavirus protocols for disinfection and testing of containers being passed through to cold storages.

And the situation now - although it has not drastically improved, has not drastically worsened either.

Our sources advised that the few major processing plants that are currently open are said to have a good amount of raw materials on hand enough for current and future orders.

They also advised that the number one cold storage in Yidu will be opening mid-May.

Once this cold storage opens, processing plants should not need to purchase raw materials immediately and the forecast is that pricing will be stable for a while.

However once the raw materials are used up and the plants need to purchase more, pricing will go up dramatically, all while strong demand is to come from the US and EU around October.

As China continues to impede on Russian raw materials from entering the country, Russian boats on the other hand, are said to not want to ship to China anymore as well - ultimately resulting in higher prices from a lack of raw materials.

---On the North American side, the vessel offloading turn around time has improved but cargo is still backing up.

Cold storages in China haven't been able to get booking confirmations for their shipments which is delaying ship dates.

For example, container volume offshore in Los Angeles has gone from around 40, down to about 20 waiting for berth.

From there, things are moving onto rail within a week of being offloaded, but there continue to be some delays in transit.

Advertise Here: advertising@tradexfoods.com

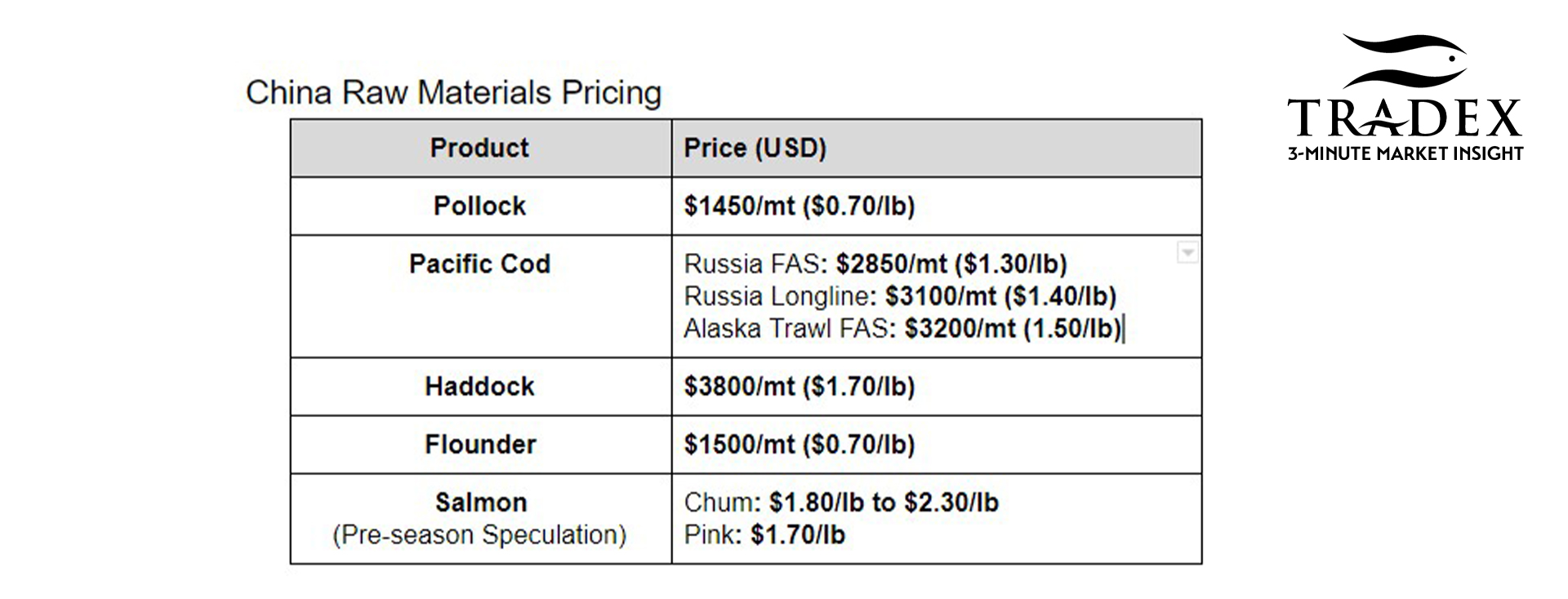

Now moving onto the state of raw materials pricing in China.

For Pollock, pricing on Russian raw materials is to continue climbing as Russian boats don’t want to, and can't afford the cost of shipping into China.

Current raw materials pricing on Pollock is $1450 per metric tonne USD (or $0.70/lb).

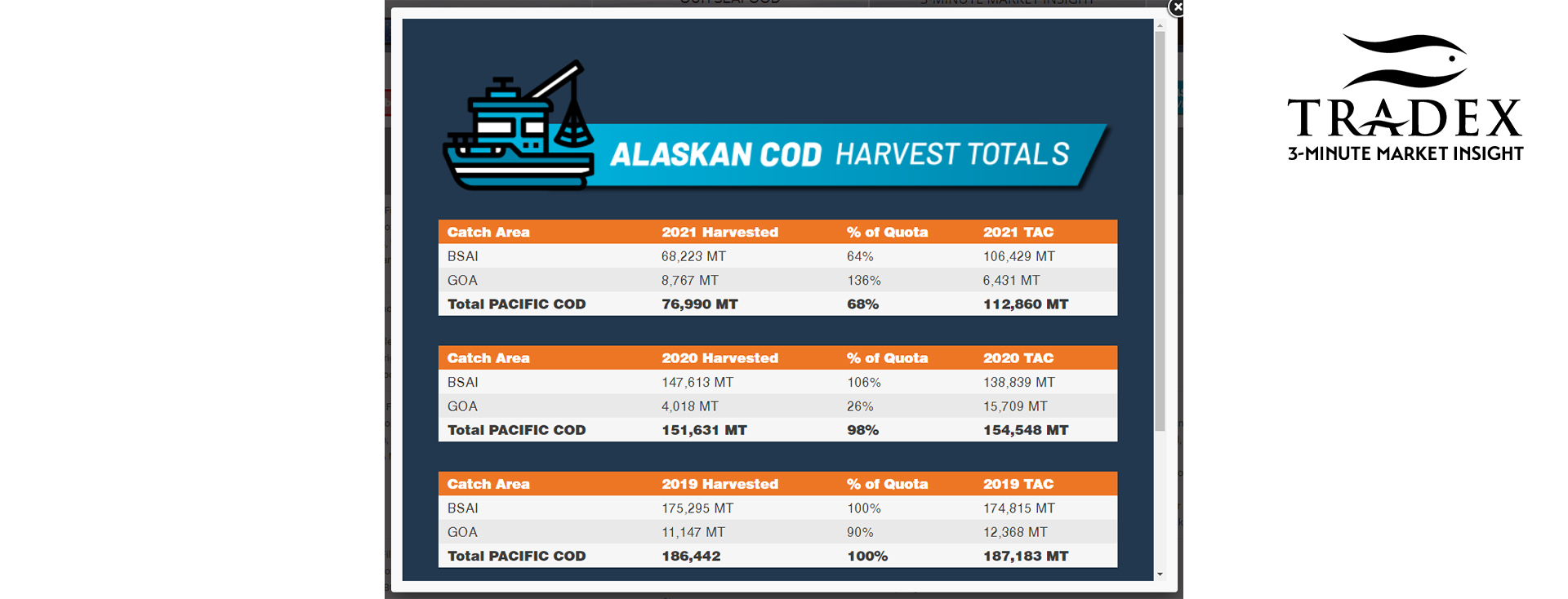

For Pacific Cod, pricing is gradually increasing as there is significantly less Alaskan raw materials than last year from a 27 percent quota cut, all while Russian boats are to stop shipping to China.

Current raw materials pricing on Pacific Cod ranges from $2850 per metric tonne USD (or $1.30/lb) for Russian frozen at sea to $3200 (or $1.50/lb) for Alaskan trawl frozen at sea.

For Haddock, raw materials pricing has gone up a lot as Russian fish can't go to China which has led to the prices of Nowegian Haddock to rocket from $3200 to $3800 per metric tonne USD (or $1.70/lb).

And lastly for Salmon, some pre-season chatter has processors speculating Alaskan raw materials pricing to range between $1.80 to $2.30 for Chum and $1.70 for Pinks.

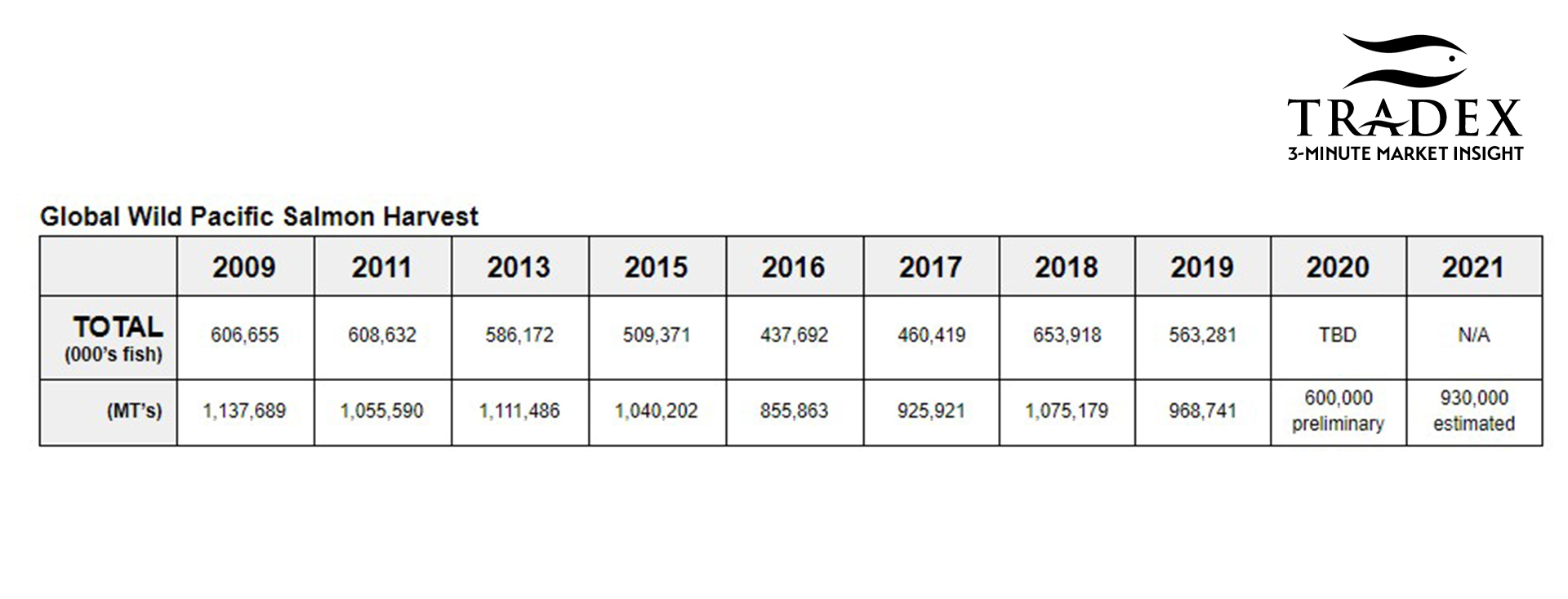

It's going to be a bigger year for Wild Salmon than last year with an odd-year surge in Pink Salmon from both Alaska and Russia.

Global Wild Salmon harvest this year is predicted to reach about 930,000 metric tonnes compared to the 600,000 metric tonnes produced last year.

Our recommendations are to 1 - contact us before making any purchases, 2 - start making your Chum Salmon commitments now, and 3 - keep tuned into this weekly update as we help navigate another year of supplying seafood through a pandemic.

--- If you are not already, be sure to subscribe to our 3-Minute Market Insight using the signup form below to keep tuned-in to all upcoming market insights.