Loading

EP 518 | AIRED 12/14/2020

2021 Salmon Market Predictions

December 14th, 2020 --- This week we provide our Salmon Market Predictions for 2021 on Wild Caught Pacific Salmon.

--- Looking past the new year and we are forecasting for another year of high demand and a market stretched on supply for Wild Caught Pacific Salmon.

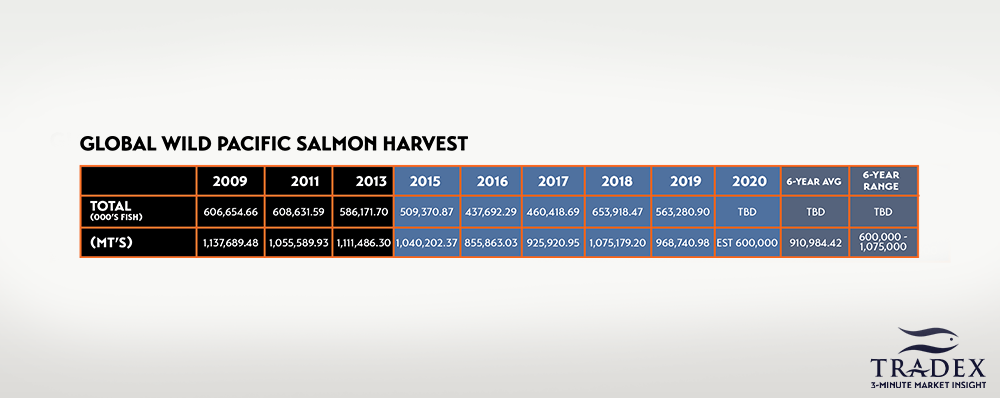

Globally, preliminary Wild Pacific Salmon harvest totals for 2020 will be for just slightly over 600,000 metric tonnes compared to 970,000 in 2019 and 1.07 million in 2018.

An industry expert we spoke with estimates that Total Global Salmon Harvest for 2021 could amount to around 930,000 metric tonnes when they run data through their predictive modeling algorithms.

Although 2021's forecast is higher than 2020's harvest, the estimate of 930,000 metric tonnes is actually considered low for an odd-numbered year.

Looking out even further, their predictive modeling is forecasting for a steady decline of Salmon run magnitude and catches throughout the North Pacific.

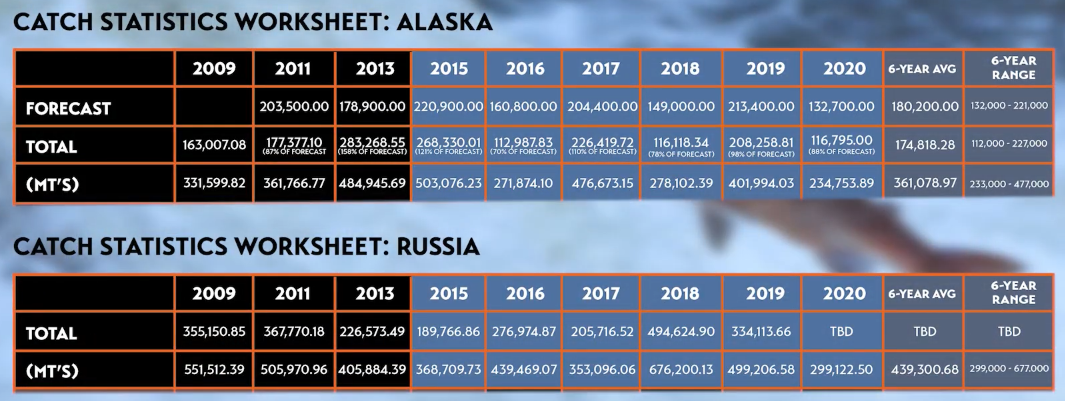

Narrowing in on the world's two largest Wild Salmon producers (Alaska and Russia) and their contribution of Wild Salmon production will be around 530,000 metric tonnes in 2020 compared to 900,000 metric tonnes in 2019, and 950,000 metric tonnes in 2018.

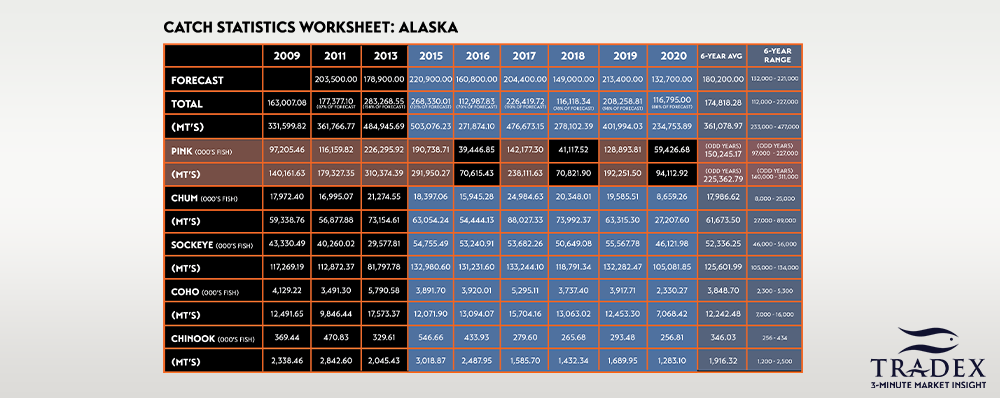

For Alaska, as we enter an odd-numbered year for the next Salmon fishery - harvest data for odd-year Alaskan harvest show a very good track record of harvesting close to forecast.

Although Alaska's 2021 Statewide Salmon forecast from the Alaska Department of Fish & Game will not be available until next March or April, odd number years typically yeild a higher production of Pink Salmon resulting in an overall higher harvest of Salmon versus even numbers years.

While ADFG recently forecasted a Bristol Bay harvest of 36.35 million Sockeye for 2021, we'd like to note that by weight, Bristol Bay accounted for 39 percent of the statewide commercial harvest for Alaska's 2020 season.

A forecast of 36.35 million Sockeye from Bristol Bay also equates to 91 percent of the 40 million Sockeye harvested in Bristol Bay for the 2020 season.

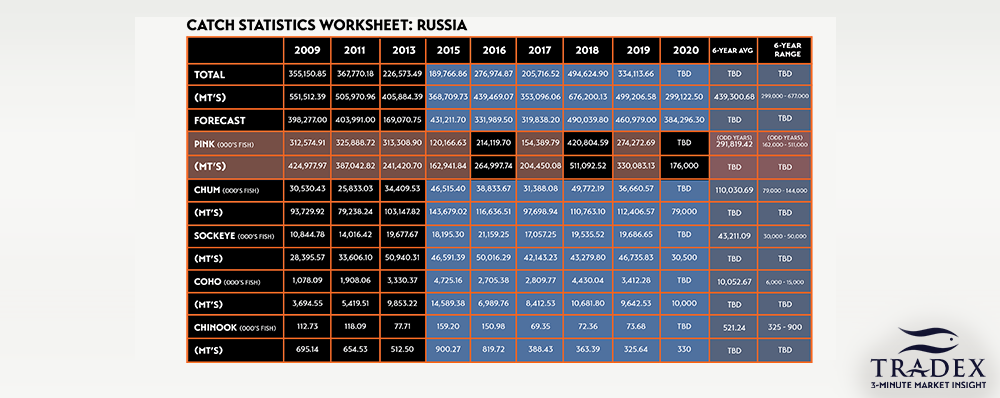

For Russia, as reported in the 3-Minute Market Insight at the beginning of this year, we advised there would be a significantly lower harvest of Pink Salmon and preliminary catch totals are currently showing about 176,000 metric tonnes compared to 330,000 in 2019 and 511,000 in 2018.

Numbers for Russia's 2020 Salmon season are still being finalized however preliminary catch totals are showing for a 300,000 metric tonne season from all Salmon species in Russia this year.

--- On a side note on Russian Salmon, commercial Farmed Salmon production in Q3 increased by 25 percent to 93 thousand tonnes in Russia.

According to Russia's head of the Federal Agency for Fishery Ilya Shestakov, Salmon farming is one of the strategic directions of commercial aquaculture with great potential in the field of import substitution and that their plan is to saturate the domestic market with Russian products.

--- Moving onto the market side and 2020 saw an overall increase in consumer demand for Salmon through retail with a particular strain on inventories of Sockeye, Chum, and Coho.

Although we saw another strong Sockeye harvest out of Alaska this year, all west coast fisheries beneath Alaska failed to produce any significant amounts of Salmon throughout 2020.

The effects of COVID shifted the market from fresh Salmon to frozen and canned sales and we will have a better pulse in 2021 on whether the market transitions back to fresh as the COVID-19 vaccine rolls out.

However whether the fresh market makes a return or not, we anticipate another year of high demand for Sockeye Salmon and limited inventories of Chum and Coho.

If Pink Salmon numbers come in like other odd-year harvest, we may see some downard price pressure in the Chum Salmon market and a robust Pink Salmon harvest should not have an affect on other Salmon species.

If Alaska does not see a higher Salmon harvest in 2021 compared to 2020 - then I think we can all agree that stranger things have happened.

--- 2020 was a challenging year for the seafood industry but I personally know most of the industry was able to make it through and I'm looking forward to moving the seafood industry forward in 2021 with our customers and vendors.

On that note, this will be out last episode for 2020 and the 3-Minute Market will be back with a brand new episode Monday January 4th, 2021.

If you are not already, be sure to subscribe to our 3-Minute Market Insight using the signup form below to keep tuned-in to all upcoming market insights.

--- Thank you for joining me for the Tradex Foods 3-Minute Market Insight

This has been Robert Reierson, reminding you to stay safe, buy smart, and eat more seafood.

2020 Salmon Episodes:

Nov 23, 2020 - Chum, Sockeye, Halibut All Short; What Should You Do?

Nov 09, 2020 - Buyer's Update: Salmon, Pollock, Swai, Tilapia, Haddock, Atlantic Cod, Halibut, Albacore Tuna

Oct 19, 2020 - STATE OF THE PACIFIC SALMON - DFO, Listen to the Testimony

Sep 28, 2020 - Russian Pink & Chum vs Alaska’s Salmon Season

Sep 21, 2020 - How Smaller Salmon Could Change the Industry

Aug 31, 2020 - Hokkaido, Russian and Alaskan Chum’s Update

Aug 24, 2020 - What Happened to Wild Salmon Populations in BC?

Aug 17, 2020 - Current State of Sockeye & Chum Salmon Market

Aug 03, 2020 - Buyer's Update on the Current Market Conditions for All Wild Pacific Salmon

Jul 27, 2020 - Not All Farmed Salmon Are Created The Same; The Future of Farmed Salmon

Jun 29, 2020 - Buyers Update: Alaska Salmon and China Production

May 04, 2020 - Global Salmon Update, COVID-19 Alaska Mandates, 2-Month Salmon Purchasing Advice

Mar 09, 2020 - Will There Be A 2020 Fraser River Sockeye Fishery?

Jan 20, 2020 - The 2019 Russia Pacific Salmon Fishery