Loading

EP 513 | AIRED 11/09/2020

Multi-species Buyer's Update: Salmon, Pollock, Swai, Tilapia, Haddock, Atlantic Cod, Halibut, Albacore Tuna

November 9th, 2020 --- This week we provide a Multi Species Buyer's Update as we move through fall into Holiday Season purchasing and then into preparations for Chinese New Year Closures.

--- Starting with Salmon; Sockeye's and Chum's are still trending as items in high demand across North America.

Washington state's Puget Sound Chum fishery is the West Coast fishery producing Chums at the moment as Alaska's fishery has finished and British Columbia's fishery essentially non-existent.Preseason run size forecasts for Puget Sound Chums were for about 760,000 fish compared to "actual" run sizes of 1.27 million for 2018 and 1.72 million for 2017.

We heard that the fish have paled out and landings were light this year.

In fact we just received word that the Puget Sound fishery is basically done for the year.

We will report more on this as details unfold.

Tradex currently has Chum fillets and portions in Los Angeles but we anticipate this to become a short item.

Inline with what we have been reporting all year - the Chum Salmon market is short and will continue to be short.

The Sockeye Salmon market continues to be in high demand as it continues to be a popular item that keeps moving.

2-4 and 4-6 lb Sockeye's continue to sell as quickly as offers hit the market with 2-4's still being non-existent.

Over in China, (to quote our VP of Asia Operations), "Pink Salmon is getting crazy".

Russian boats are asking for up to $3600 per metric tonne (or $1.60/lb U.S.) and plants believe pricing will go even higher before the Chinese New Year closures.

Chum Salmon raw materials are short as well with pricing around $4700 per metric tonne (or $2.10/lb U.S.).

--- Moving onto Pollock and Alaska's Pollock "B" Season just came to a close with millions of pounds of quota left unharvested due to poor fishing conditions and smaller sizing of Pollock.

On the once-frozen side, there will be limited amounts of 2-4 and 4-6oz Shatterpack, IQF, Fillet Block and Surimi available.

We do not expect to see any volume of fillets available until the end of February next year which is after the 2021 Pollock "A" Season gets underway.

Pollock has been a steady protein throughout the pandemic however we are anticipating some strengthening in demand for Alaska Pollock which will put pressure on prices for Alaska and Russian supply.

In fact, on the twice-frozen size, recent updates out of our China Office reported that raw materials pricing are continuing to rise on the backs of stronger demand from EU And North America.

Our recommendation is to buy now to last you to at least March of next year.

As a leader in foodservice supply, we take pride in being able to remain a strong and stable supplier even amidst fluctuating pricing and supplies during a global pandemic.

If you are looking for a knowledgeable, stable and transparent seafood supplier, please don't hesitate to even contact me directly - rob@tradexfoods.com.

The Swai market is going up as production is booked solid in Vietnam for the next two months - and as demand continues to rise in the U.S., we recommend you get your purchasing requirements in now.

The Tilapia market continues to be strong through the pandemic and Chinese production is already full before Chinese New Year closures so our recommendation is to buy hand to mouth as we anticipate pricing to come down by March and April.

Haddock raw materials pricing continues to climb due to poor harvest - as we anticipate short supply and high demand before Chinese New Year, we recommend purchasing Haddock requirements immediately.

Atlantic Cod raw materials pricing remains low at $3700 per metric tonne (or $1.70/lb U.S.) and we anticipate this market to remain stable as Russia and Norway are reporting good catches and an increase in quota 20 percent over last year.

Russian Halibut raw materials are on the rise and the Pacific Halibut fishery is coming to an end - with only 80 percent of the fishing limit harvested the Halibut market is going to run into short supply problems and our recommendation is to secure your requirements now.

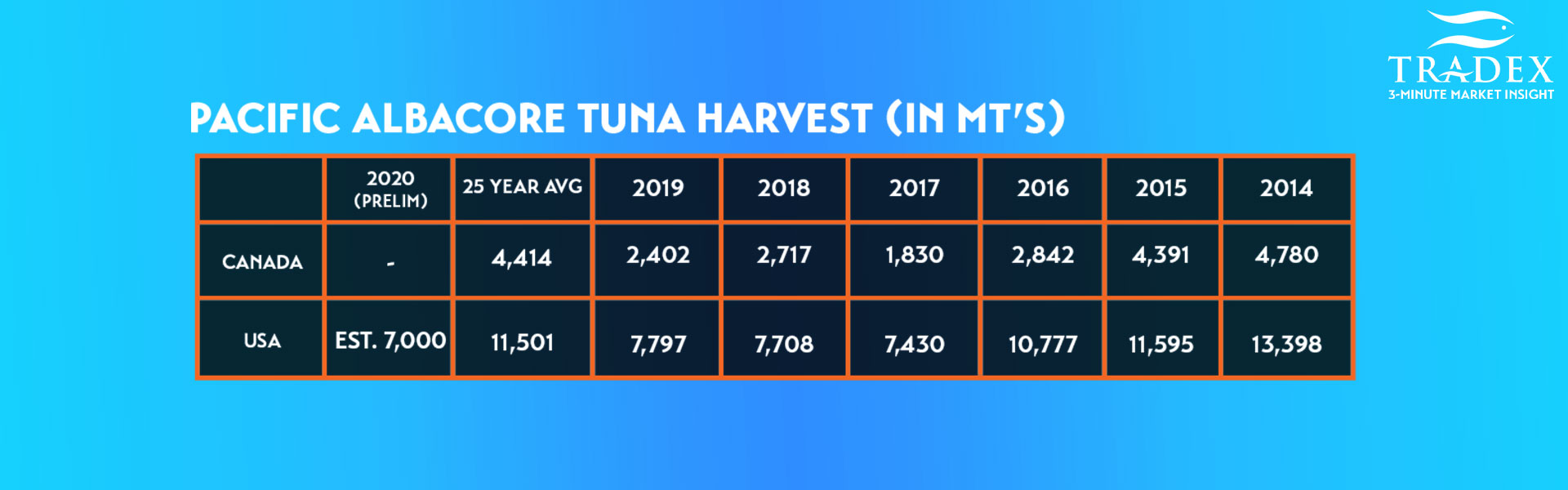

Albacore Tuna landings actually came in similar to previous seasons in both U.S. and Canadian waters despite a slow start and COVID disruptions - average size was up this season at 12-14lb and current pricing in B.C. is reporting lower than 2019 production.

Keep tuned into our 3-Minute Market Insight as we will update in further detail the species reported today.