Loading

EP 511 | AIRED 10/26/2020

2020 Global Squid Update

October 26th, 2020 --- This week we give you an update on the current state of the 2020 Global Squid Market and the effects of Covid-19, industry disruptions, and season closures.

This has been a particularly rough season for the Squid industry, as the cephalopod market felt the effects of the Covid-19 pandemic harder than most.

As the foodservice sector is where the majority of the demand for squid occurs, exports of squid from China came to a stand still in the spring.

In the summer, our sources confirmed that processors weren't purchasing new product as they were still sitting on inventories.

Chinese plants are now open and are attempting to produce enough product to compensate for these losses, especially before Chinese New Year closures in February.

Although our sources in China have confirmed that as of September, China's restaurants are returning to normal operations and demand for tubes, tentacles and rings is slowly picking back up.

Our recommendation for this season is to contact your Tradex foods representative about purchasing your squid needs as soon as possible, as demand begins to increase again, so will pricing.

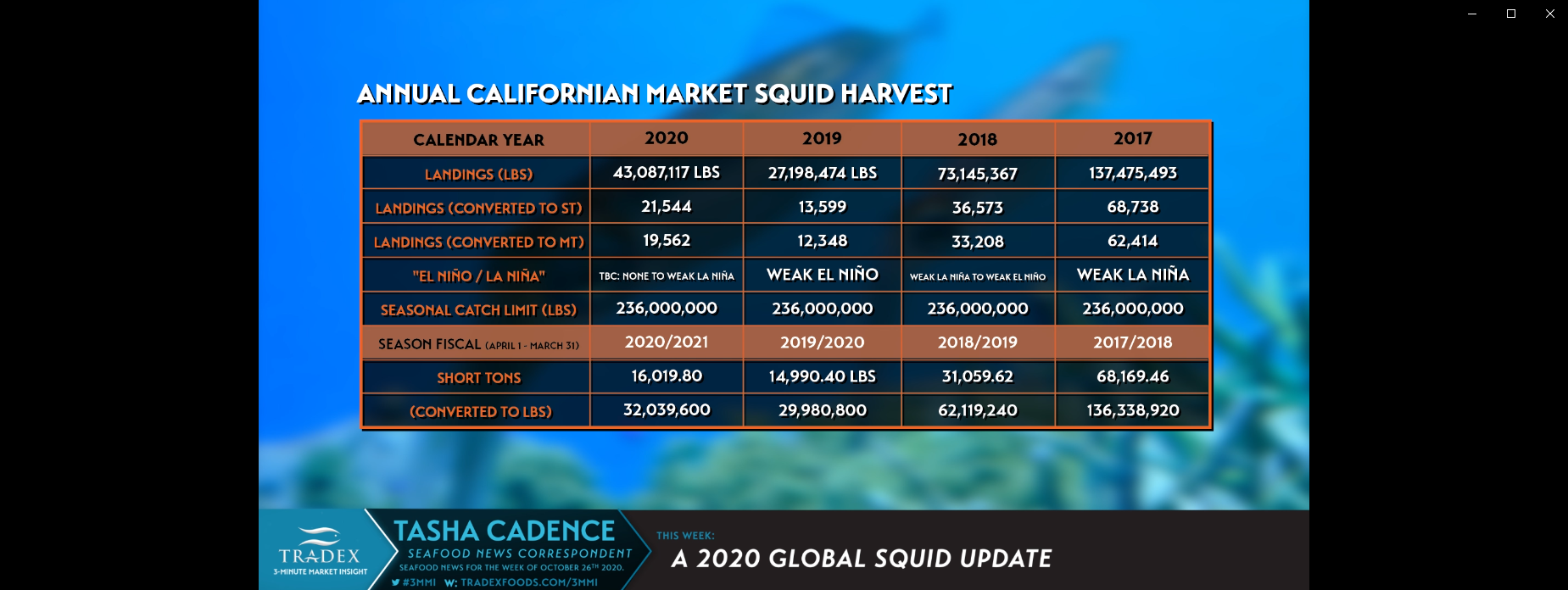

Compare this to 27 million lbs in 2019, 73 million lbs in 2018, and 137.5 million lbs in 2017. Fishing efforts seemed to have taken a pause since August but a recent uptick in October might suggest that the fall and winter fishing is starting back up.

In 2018, fall/winter fishing saw 1.5 millions lbs harvested in October, 17.5 million lbs in November, 12.3 million lbs in December, and 6 million lbs for January 2019.

The latest forecasts from the WMO Global Producing Centers of Long Range Forecasts indicate that tropical Pacific sea surface temperatures are likely to cool further, with a 55-60 percent chance of La Nina between now and February 2021.

Though fishery managers cannot confirm a relation between oceanic temperatures and landing numbers, colder waters do tend to contribute to stronger upwelling and higher primary productivity.

2018 experienced Weak La Niña to Weak El Niño events, and was met with an especially poor harvest, so there is a potential for a cooler and hopefully more productive, 2021 season.

The Illex and Tordorodes are the primary species being purchased by Chinese plants at the moment, and our buyers are also hearing of an increasing demand for Loligo Chinensis.

The majority of imports coming from Argentine and Peru, and destined for the US, Canada and the EU.

Yields from Argentina were higher than normal, bringing in an abundant 66,000 tonnes of Squid from Buenos Aires in 2020, the highest yield from the region since 2005.

While the catch was high, it wasn't an easy season for Argentine vessels, as social distancing laws enforced reduced crews making operating much more difficult.

When purchasing from Argentina we've heard reports of a cash-up front rather than Letters of Credit, paying cash prior to receiving cargo does not allow for claims or mis-shipments ect, as you are aware - this can be risky business, so buyer beware.

And of course, don't hesitate to contact us at Tradex prior to making any purchasing decisions for some expert advice.

It has been reported that more than 100 foreign vessels are fishing just outside the borders of the Argentinian waters, including Korean, Portuguese and Chinese vessels, some even seeing arrests in May.

China’s distant-water fleet is monitored by China’s Fishery Bureau in cooperation with the Chinese Overseas Fisheries Association, and a new draft of a management system proposed by China’s Ministry of Agriculture is now being reviewed.

If approved, this will restrict Chinese vessels in the South Atlantic squid fisheries, including seasonal fishing closures, human observers and electronic monitoring coverage.

In June this year, China's Ministry of Agriculture’s Bureau of Fisheries announced the closure of two seasons on squid fishing in parts of the south-west Atlantic and eastern Pacific, to ensure two species a better chance of reproducing.

This is the first time China has voluntarily imposed a closed season on the high seas.

Some experts are viewing this as an important step forward in China’s management of distant-water fishing, and vital for protecting the squid fishing industry.

But others say the impact will be limited and a stronger oversight of fishing vessels is necessary, or even a new squid-focused fisheries management body.

Stay tuned as we keep you updated on the state of the Squid and foodservice industries, as they attempt to find a new normal.