Loading

EP 470 | AIRED 01/06/2020

2020 New Year’s Buyer Update: Cod, Haddock, Pollock, Halibut, Flounder, Sole

January 6, 2020 --- This week we're giving Seafood buyers a New Year's market-wide update on major whitefish species for 2020 - Let's start with Pacific Cod.

As there won't be much Pacific Cod catching from January to April, boats will be focused on Pollock.

Our sources have informed us that Russian boats started raising their prices.

Pricing on Russian fish is still at lower levels, and are about $700-800 cheaper than Alaskan fish.

The Gulf of Alaska Fishery has been closed, which will in turn stabilize the cod market going into Q1 of 2020.

We have actually heard that some plants in Yantai are selling to EU at a very competitive price and that this fish is being harvested from the yellow sea.

Their pricing is around $2500/MT or $1.13/lb USD for H&G, but mostly small 2-4, 4-6 and 6-8oz fillets. No MSC, no catching certificate.

Raw materials pricing for Pacific Cod in China will start increasing from the lowest of Russian trawl at $2800-2900/MT, around $1.27/lb USD, ranging to the higher end with Alaskan long line between $3900-4000/MT, which is $1.79/lb USD.

If you're looking for Cod, we have options on 2019 Trap caught FAS Cod at $1.82/lb FOB Nert in Boston – this is for a 5-7lb, and we highly recommend pre-booking your current needs.

--- Continuing with other white fish, Atlantic Cod pricing has remained steady since last year at $4550/MT or 2.06/lb USD.

0.5kg to 1kg pricing is cheaper, at around $4200 or 1.90/lb USD due to loss of demand.

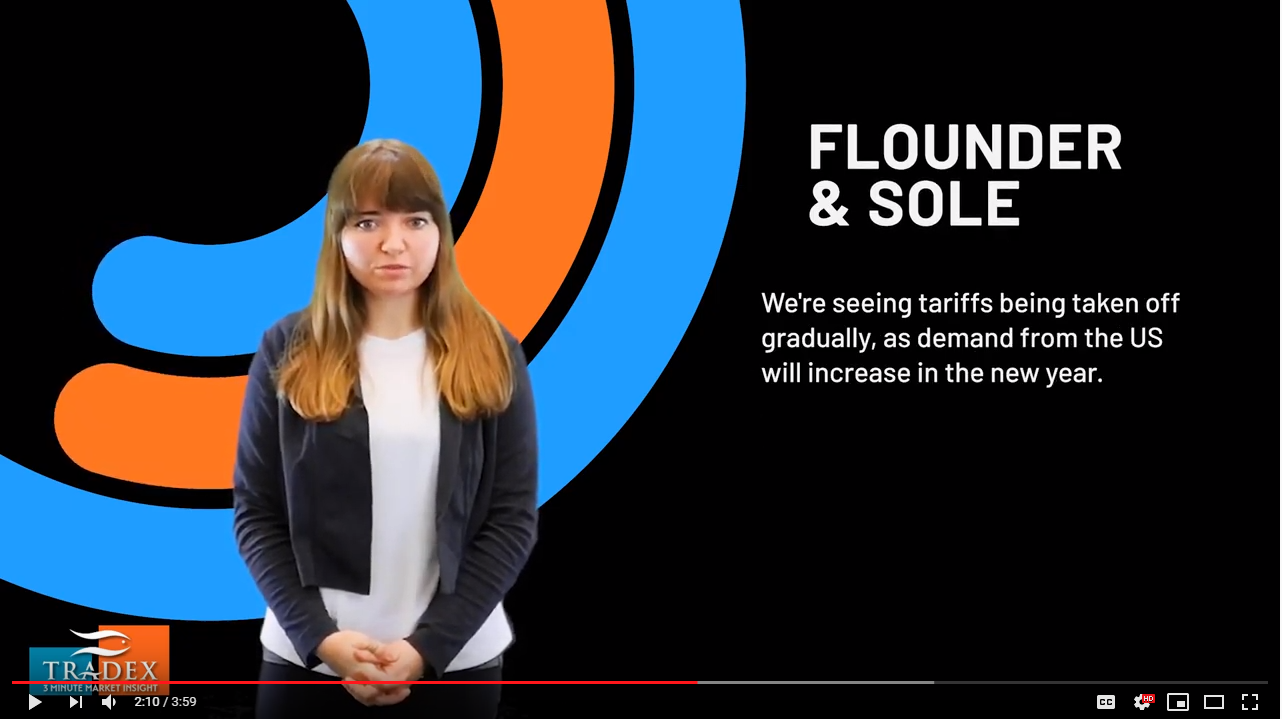

In Flounder and Sole, we're seeing tariffs being taken off gradually, as demand from the US will increase in the new year.

Alaskan boats have started to raise their pricing from $1800 to $1900/MT.

Rock Sole continues to be very short, with 3L and 4L almost non existent.

We have seen offers for 4L for above $3/lb.

Haddock raw materials pricing is softening, we're hearing from plants in China that it's selling for $3100 CFR, down from $3200/MT in early December, which translates to around $1.41/lb USD.

With Halibut in Russia, levels are still low, so now is a good time to take inventories.

Pricing is around $7500/MT CFR China right now, so around $3.40/lb USD, and continuing to go up. --- Moving onto Pollock, Raw material pricing will be available in about 2 weeks.

This is the period that raw material is very short and expensive because older fish is almost fully utilized and new fish hasn’t arrived yet.

Some plants need raw material for production before Chinese New Year however, they can’t get fish even if they are willing to pay $1750/MT or $.79/lb USD.

Plants are hoping to see pricing for new fish around $1,250/MT or $.56/lb USD.

In North America we currently have options on Whole Round Pollock out of Vancouver. Options for H&G out of BC will be available January/February.

If you have needs for H&G, we highly recommend you lock in pre-commitments.

If you have a topic you'd like to hear on upcoming 3-Minute Market Insights, tweet us on Twitter @TradexFoods